Follow @JFDI

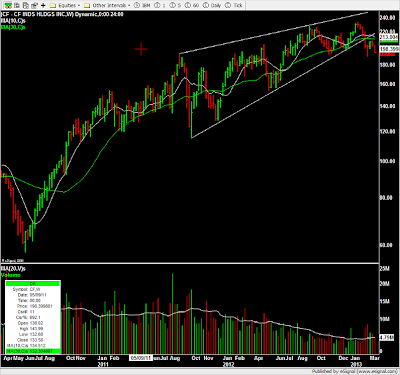

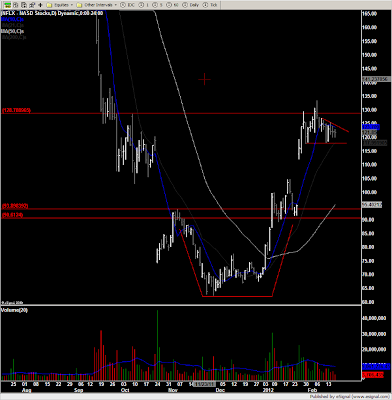

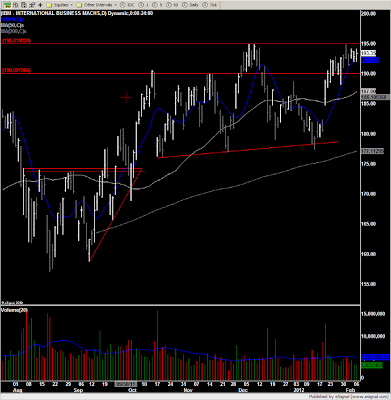

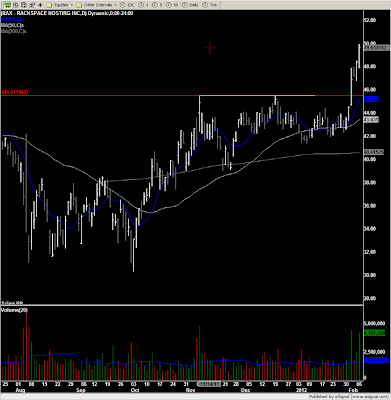

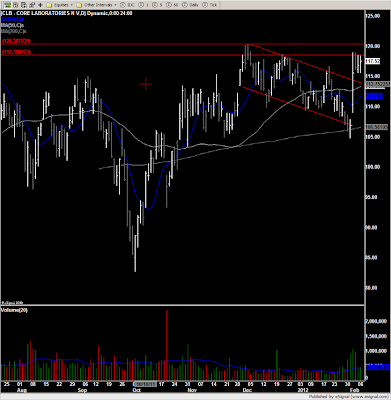

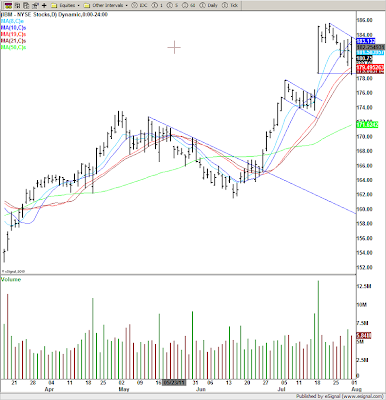

A lot of stocks on the Market Smith Growth 250+ list have made runs of 20%-100% since the beginning of this intermediate up trend that began on on the low of 11/16/12 and really got moving on 12/31/12. For me, just because the Indexes are starting to act sloppy and erratic doesn't mean I am hoping on the short side and I am not cutting my longs either. This is one of those times where less is more. I have taken profits in most of my winning positions and down to core size in each. Trails stops set in what I have left.

This is just a list of names that have come across my scans. I continually watch for names that hold up well in corrective and choppy markets.

A lot of stocks on the Market Smith Growth 250+ list have made runs of 20%-100% since the beginning of this intermediate up trend that began on on the low of 11/16/12 and really got moving on 12/31/12. For me, just because the Indexes are starting to act sloppy and erratic doesn't mean I am hoping on the short side and I am not cutting my longs either. This is one of those times where less is more. I have taken profits in most of my winning positions and down to core size in each. Trails stops set in what I have left.

This is just a list of names that have come across my scans. I continually watch for names that hold up well in corrective and choppy markets.

"Plan your trades and trade your plan."

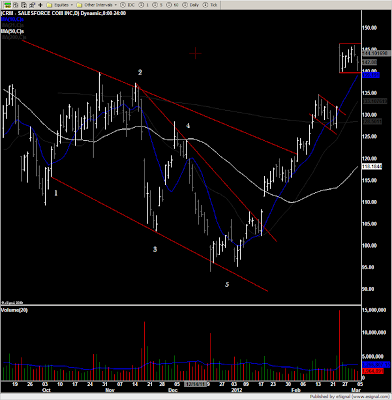

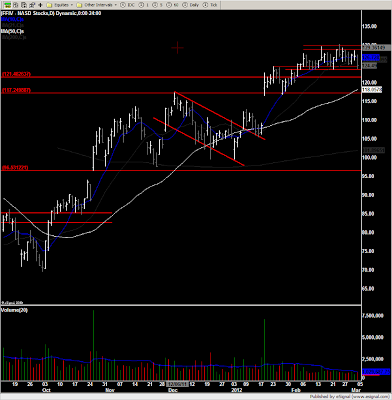

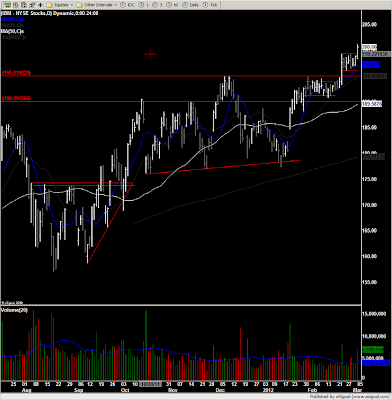

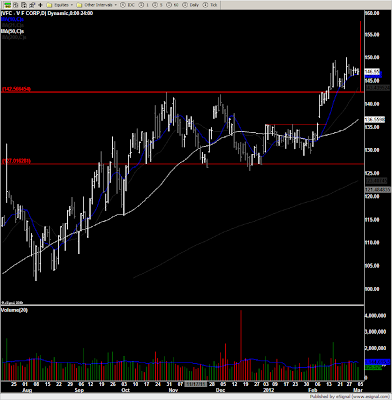

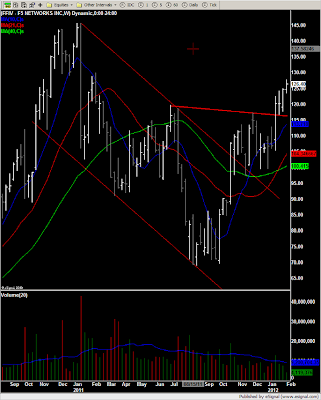

SSYS & DDD